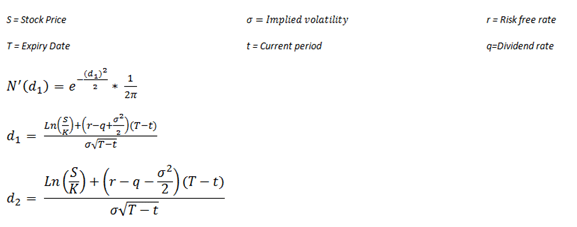

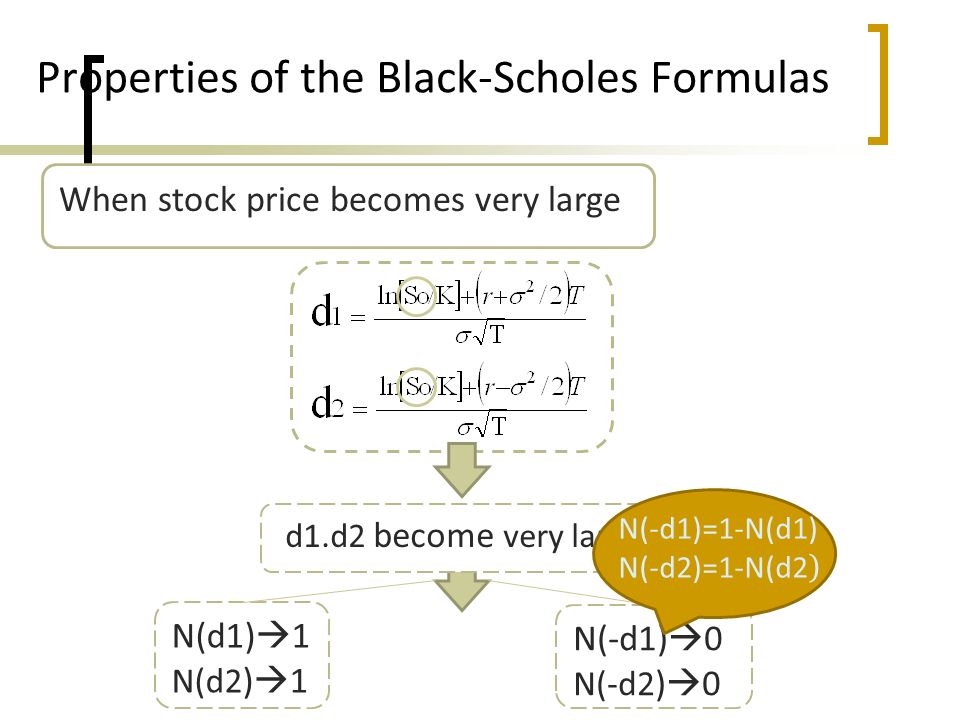

In the black scholes formula how can N(d1) represent the expected return in the event of an exercise and at the same time also mean 'delta' - probability that the option will

In the black scholes formula how can N(d1) represent the expected return in the event of an exercise and at the same time also mean 'delta' - probability that the option will

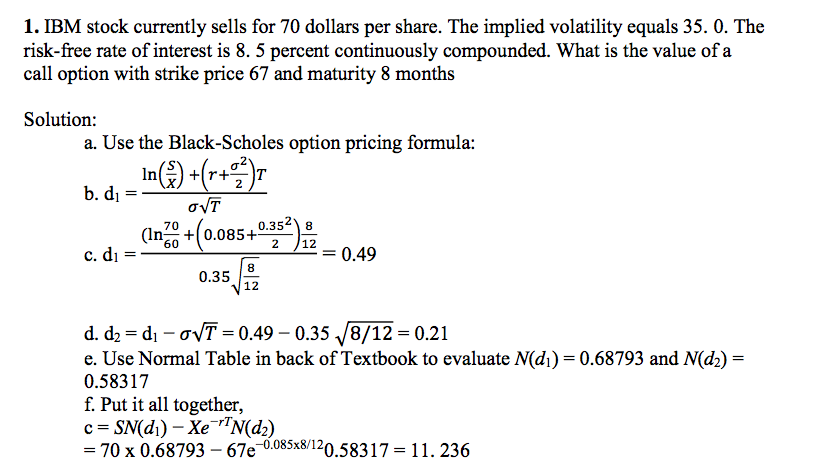

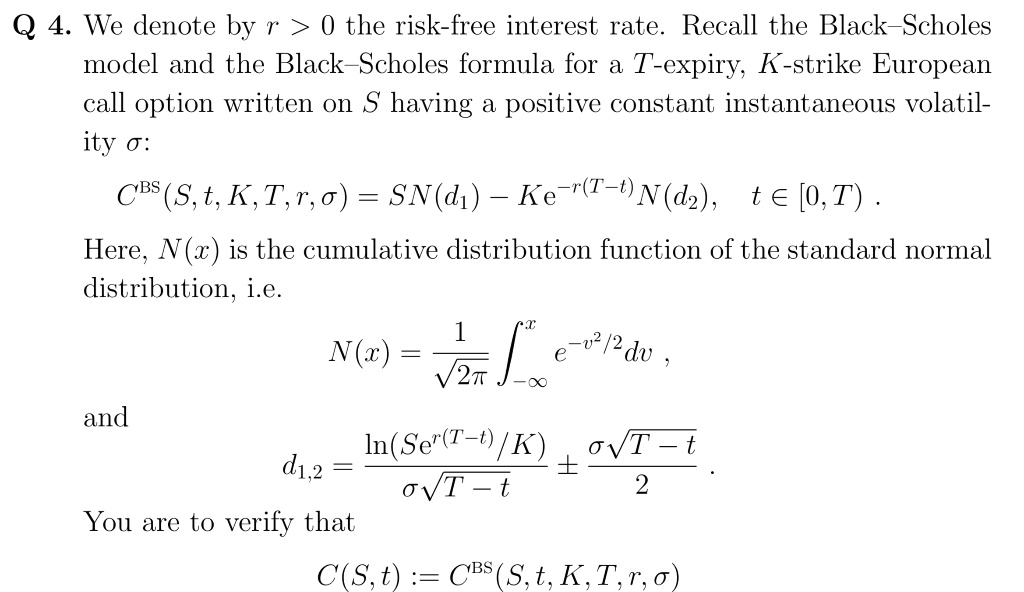

SOLVED: We denote by r > 0 the risk-free interest rate. Recall the Black-Scholes model and the Black-Scholes formula for a T-expiry; K-strike European call option written on S having positive constant

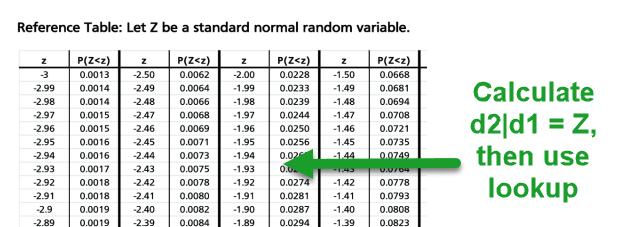

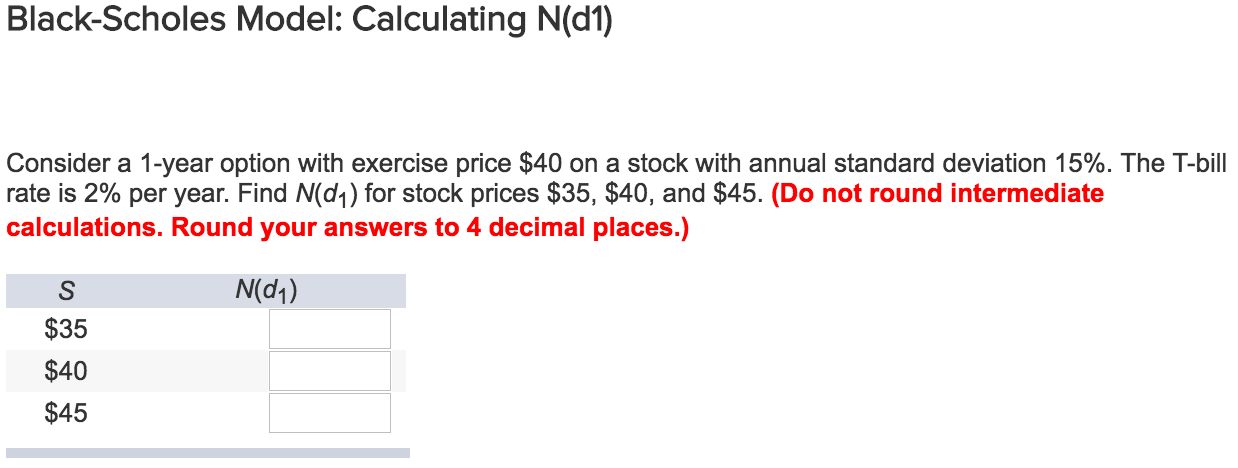

Consider a 1-year option with exercise price $60 on a stock with annual standard deviation 20%. The T-bill rate is 3% per year. Find N(d1) for stock prices $55, $60, and $65. (

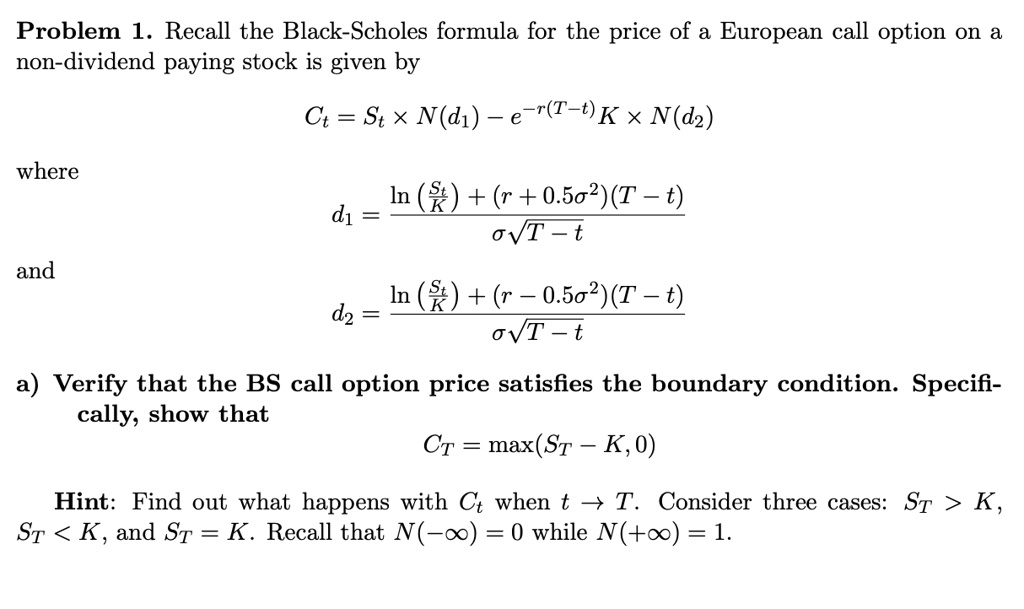

SOLVED: Problem 1. Recall the Black-Scholes formula for the price of a European call option on a non-dividend paying stock is given by Ct = St × N (d1) - e-r(T-t) × K

Implementing Newton-Raphson method to find strike price in Black-Scholes but the error value keeps increasing? - Mathematics Stack Exchange

In the black scholes formula how can N(d1) represent the expected return in the event of an exercise and at the same time also mean 'delta' - probability that the option will